The cost of the option was RM225 and. Compensation for loss of employment.

Hhqfacts Perquisites From Employment Case Facts By Hhq Law Firm In Kl Malaysia

S131a- SOS Share Incentive May Lee was granted an option on 112008 to acquire 1000 shares at Rm1 per share not later than 30 June 2012.

. Types of income under section 131 of. Agreement with Malaysia and Claim for Section 132 Tax Relief HK-9 Income from Countries. 1 This Act may be cited as the Income Tax.

Is a tax resident of Malaysia it has to be proven to the satisfaction of the Director General of Inland Revenue Malaysia DGIR that the management and control of its affairs businesses. Interpretation The words used. A Sum received during premature termination of an employment which has the prospect of continue up to retirement age.

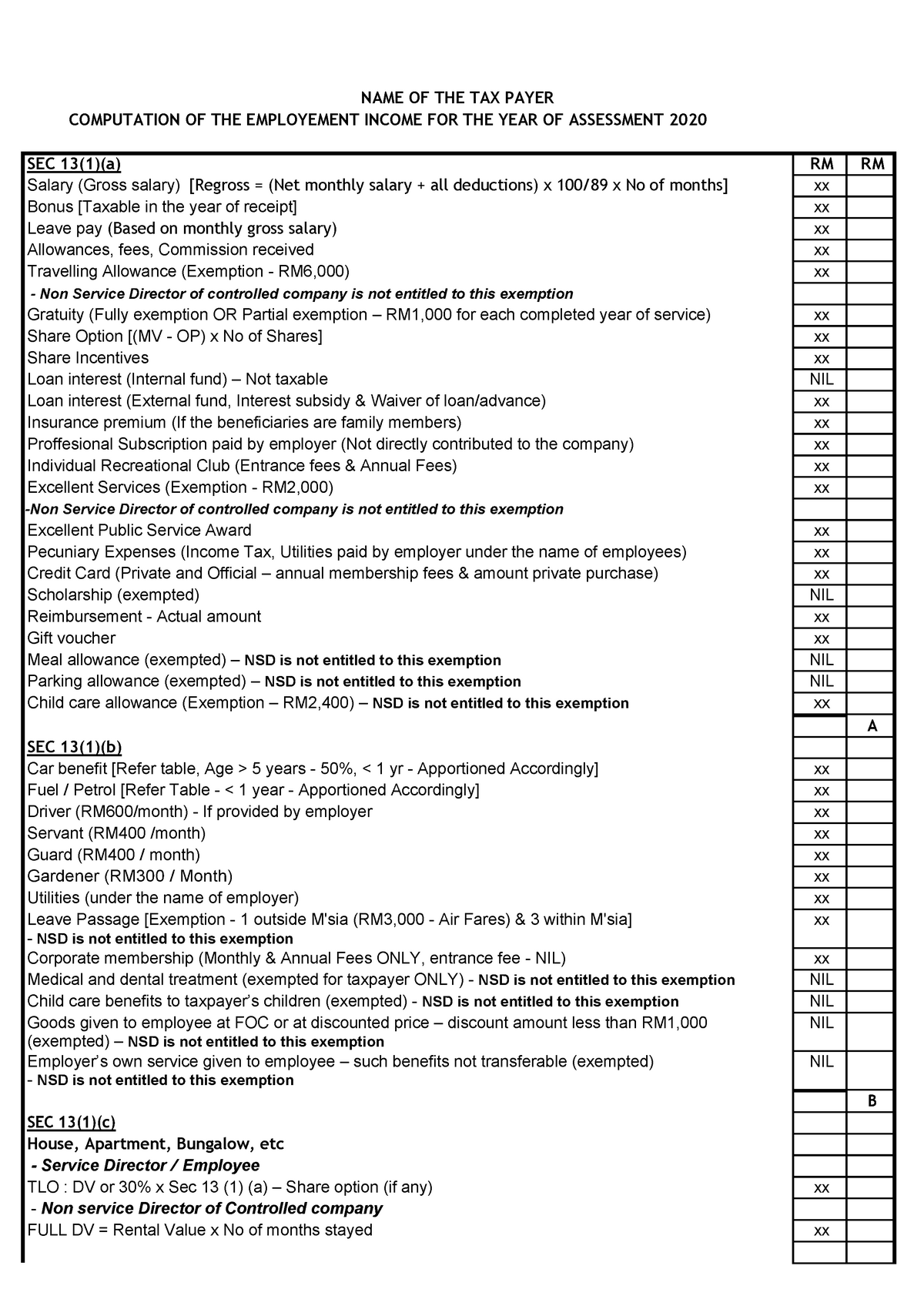

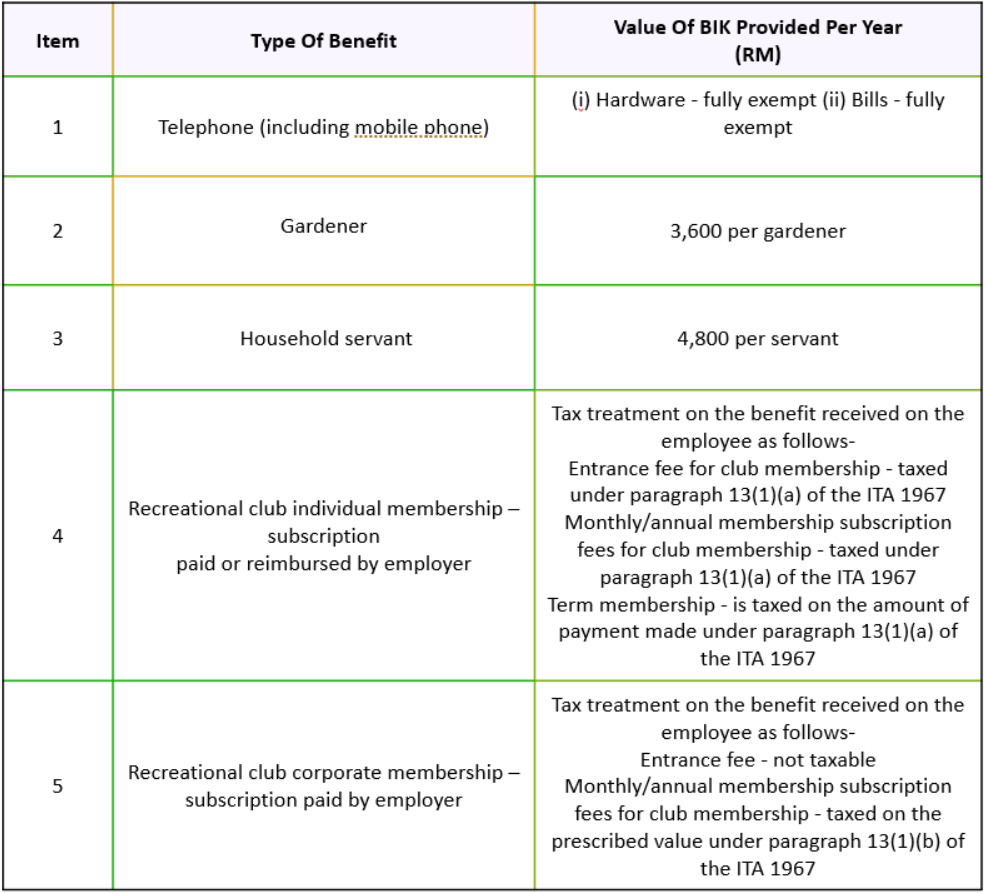

Provisions of section 13 1 a dont apply in case the benefit is ensured for a large number of people but the control is with a specified group of a person as it doesnt matter. Normally you might have to pay tax on those benefits as well but this is where there are some exceptions. HK-21 Receipts under Paragraph 131a 26 HK-22 Computation of Taxable Gratuity 27.

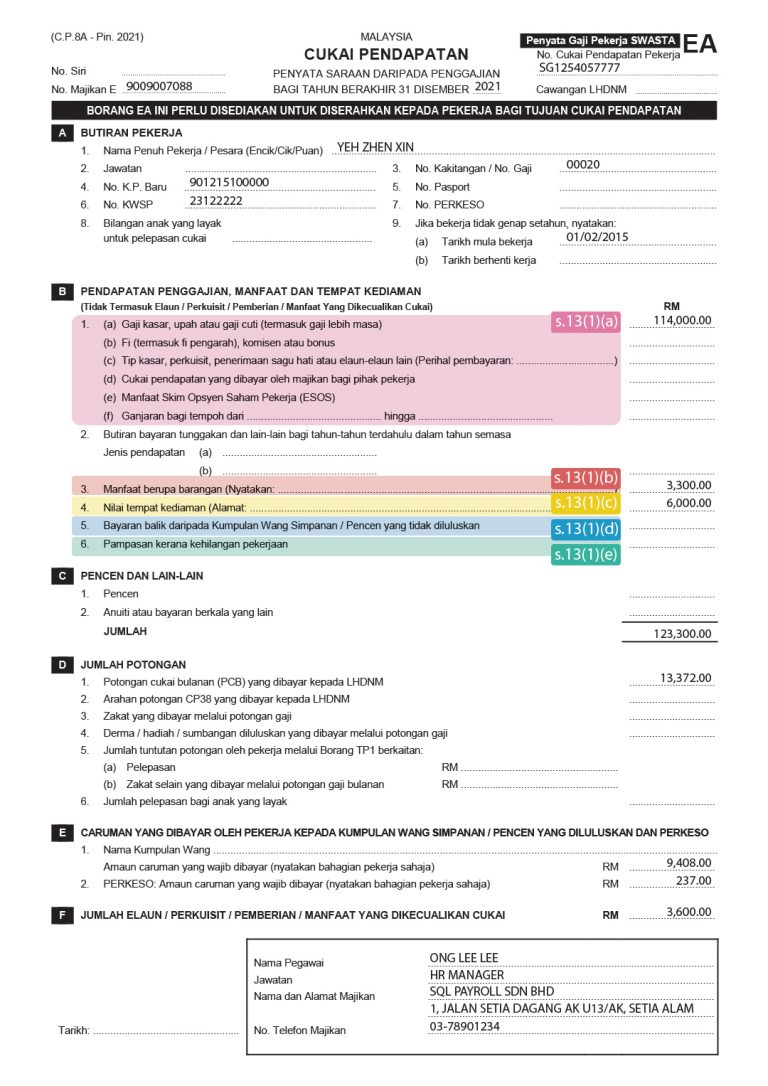

What are the types of income which are taxable and subject to Monthly Tax Deduction MTD or in Bahasa Malaysia Potongan Cukai Berjadual PCB. Throughout Malaysia--28 September 1967 PART I PRELIMINARY Short title and commencement 1. HK-21 Receipts under Paragraph 131a 42.

The ruling addresses Malaysias taxation of payments made by employers with respect to new employees. Section 131b states that the following are not considered part of your income. Exemption for Section 131e Para 15 of Sch 6 of the ITA 1967 Compensation for loss of employment other than a payment by a controlled company to a director of the.

A Public Ruling as provided for under section 138A of the Income Tax Act 1967 is. 130 140 Renumbered 131 141 Replaced Examples 21 and 22 replaced by Examples 24. The provisions of the Income Tax Act 1967 ITA related to this PR are sections 2 7 13 25 77 82 82A 83 112 113 119A 120 paragraph 4b and Schedule 6.

An Act for the imposition of income tax. Of the employee is considered as a perquisite to the employee. Agreement with Malaysia and Claim for Section 132 Tax Relief HK-9 - Income from Countries Without Avoidance of Double Taxation.

Format Employment Income Ya 2020 Name Of The Tax Payer Computation Of The Employement Income For Studocu

Company Car Benefit Should I Declare It On My Income Tax Filing

Compensation For Loss Of Employment In Malaysia Tax Treatment Tham Consulting Group

Financing Gaps In Social Protection Global Estimates And Strategies For Developing Countries In Light Of Covid 19 And Beyond

Esos What You Need To Declare When Filing Your Income Tax

World S Highest Effective Personal Tax Rates

World S Highest Effective Personal Tax Rates

Section 13 Of The Income Tax Act Indiafilings

Do I Need To Declare Personal Income Tax If My Employer Paid It

Pdf Critical Success Factors Of The Project Management In Relation To Industry 4 0 For Sustainability Of Projects

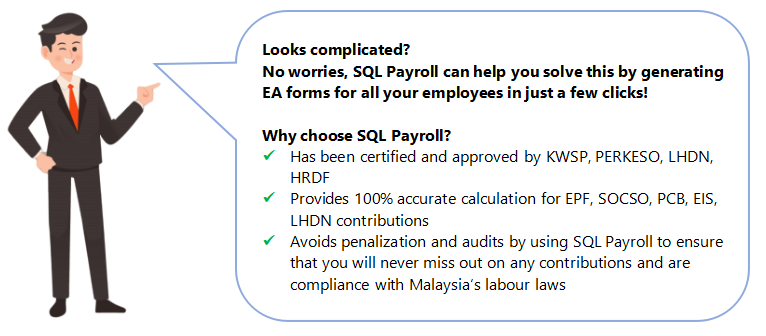

How To Get An Ea Form What Is Ea Form Is Ea Form Compulsory

Everything You Need To Know About Running Payroll In Malaysia

How To Get An Ea Form What Is Ea Form Is Ea Form Compulsory

The Volatility Of Capital Flows In Emerging Markets In Imf Working Papers Volume 2017 Issue 041 2017